Detailed report on the instrument of request.

The client will receive a detailed report on the instrument he/she is consulting CVC about. The report contains a long term cyclic view and a short term one as well. In most cases a future projection of prices will be provided if the instrument allows for the application of the Economic Wave Theory.

A live Zoom session will be held with the client to explain CVCs findings.

A live Zoom session will be held with the client to make sure the client understands all that was presented in the report. CVC will also present in this meeting the logic behind arriving at the conclusions mentioned to the client in the report.

One free follow up consultations on the same financial instrument.

CVC will be available for a free follow up consultation up to a month after your initial consultation on the same financial instruments incase any critical levels have been taken out that could result in a change in the outlook presented to the client in the report and the Zoom session.

The Economic Wave Theory

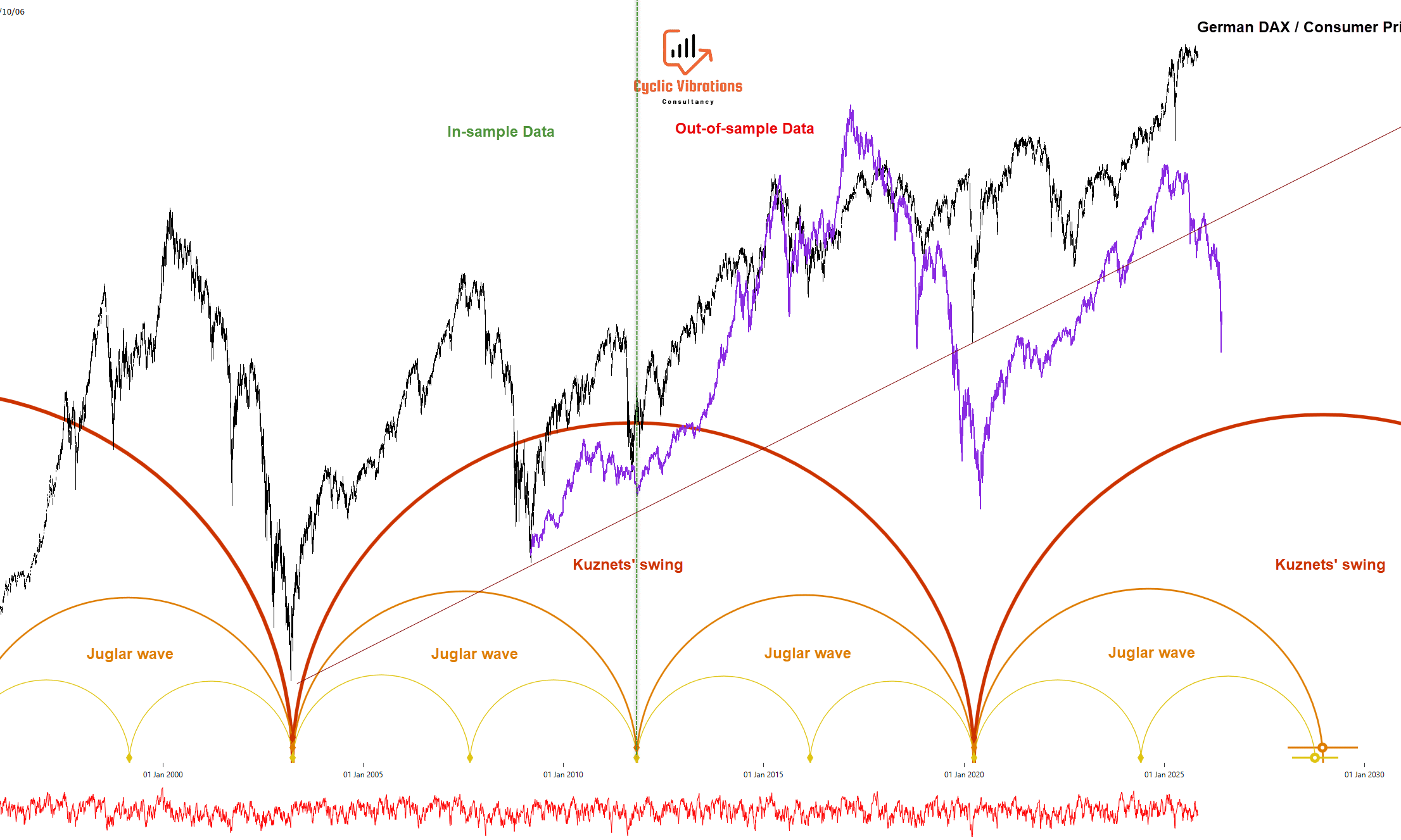

A newly developed way of looking at the markets from a cyclical perspective.

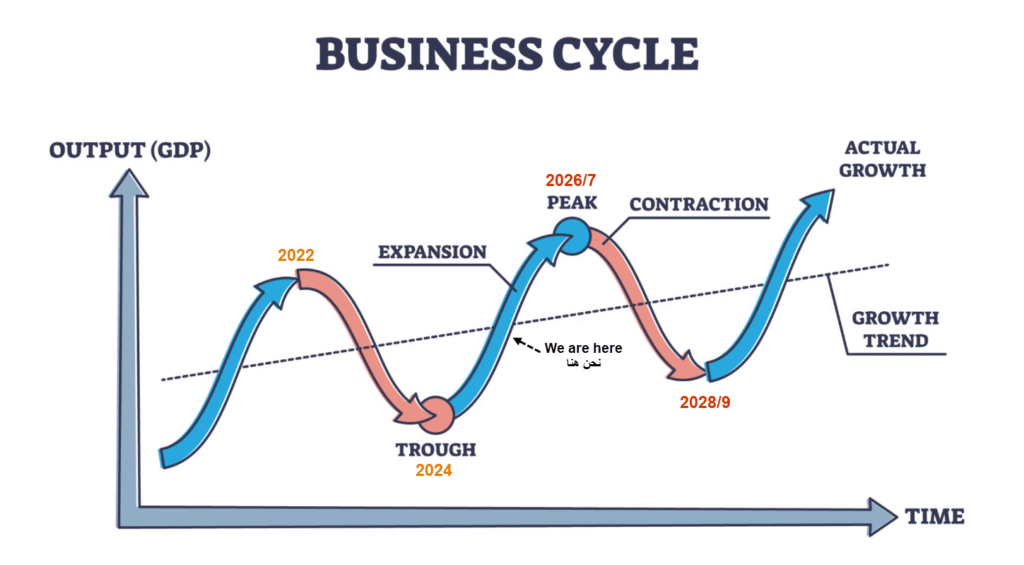

Humans tend to behave in a similar way when confronted with a similar environment that they experienced in the past. The subjects do not remember that particular circumstance but we do thanks to our collection of data. We have a model under which we apply this theory to determine which correlations are of statistical significance and which are coincidental. Once we know where to ‘look’ in the price history, which is also confirmed by the similarity in the fundamental environment, we can begin to predict the actions of humans i.e. prices with a reasonable degree of success.

A few things we’re great at

Our team is great at a lot of things. Given our experience in the marketplace, we understand the value of being humble! Here are a few things our team excels at!

Adaptability

Given the ever-changing environment in the marketplace. We have learned through the years to be adaptable and flexible rather than rigid and married to our opinions.

Immense knowledge of cyclical analysis

We have a team of experts in the field of cyclical analysis of the financial markets. We have over 10 years of experience in conducting phasing analyses of various asset classes.

Technical literacy

Our team at CVC boasts a high degree of technical literacy. We have been involved in the technical sphere of market analysis for over a decade and have gathered a wealth of knowledge and experience in applying the various technical techniques applied to market analysis

Experts in risk analysis

Our team has acquired extensive knowledge in assessing transactions and potential risks. We will assess the probabilities based on our application of cyclic logic and present our confidence level in the analysis by adding to it a percentage value i.e. the probability of our outlook playing out as expected.

Client Testimonials

Don’t take our word for it – here’s what our clients say:

Terrefic team and outstanding results. They take every single fluctuation into account and are extremely accurate when it comes to the short term and more importantly their long term forecasts are exceptional.

Wassim Azhari

Professional trader

Cyclic vibrations has shown good merit over the years. I certainly am satisfied and would gladly recommend their services to friends and colleagues! They offer institutional level reports for a price affordable to retail investors.

Islam Shoushan

Investor and entrepreneur

Join us! and begin your journey into cyclical analysis of financial markets

Latest Updates

Access some of our articles on our blog below!

Understanding the ‘Seal of the Prophets’ in Eschatology

Image 1 The claim that a figure is the “Seal of the Prophets” fundamentally suggests a specific theological perspective on the timeline of divine revelation: namely, that the era of[…]

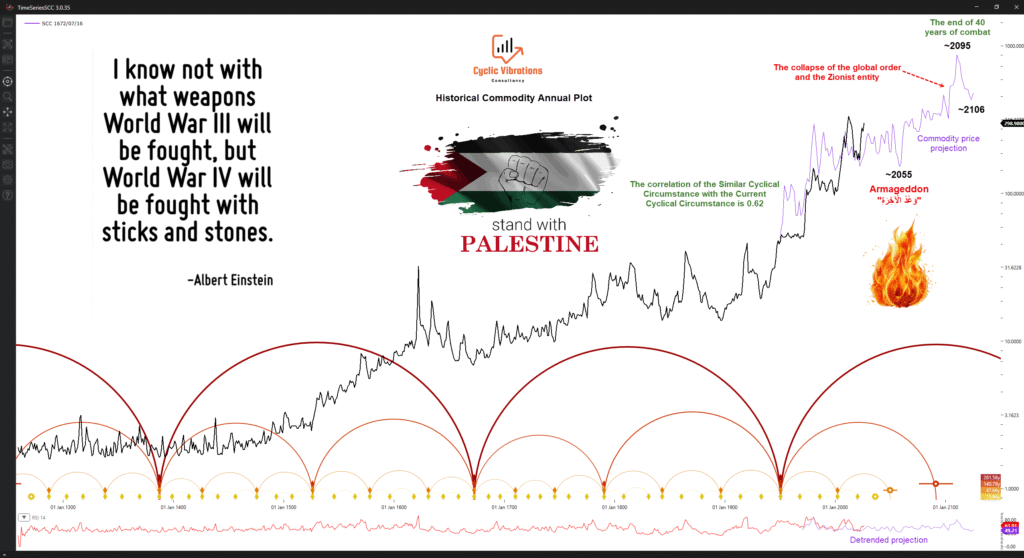

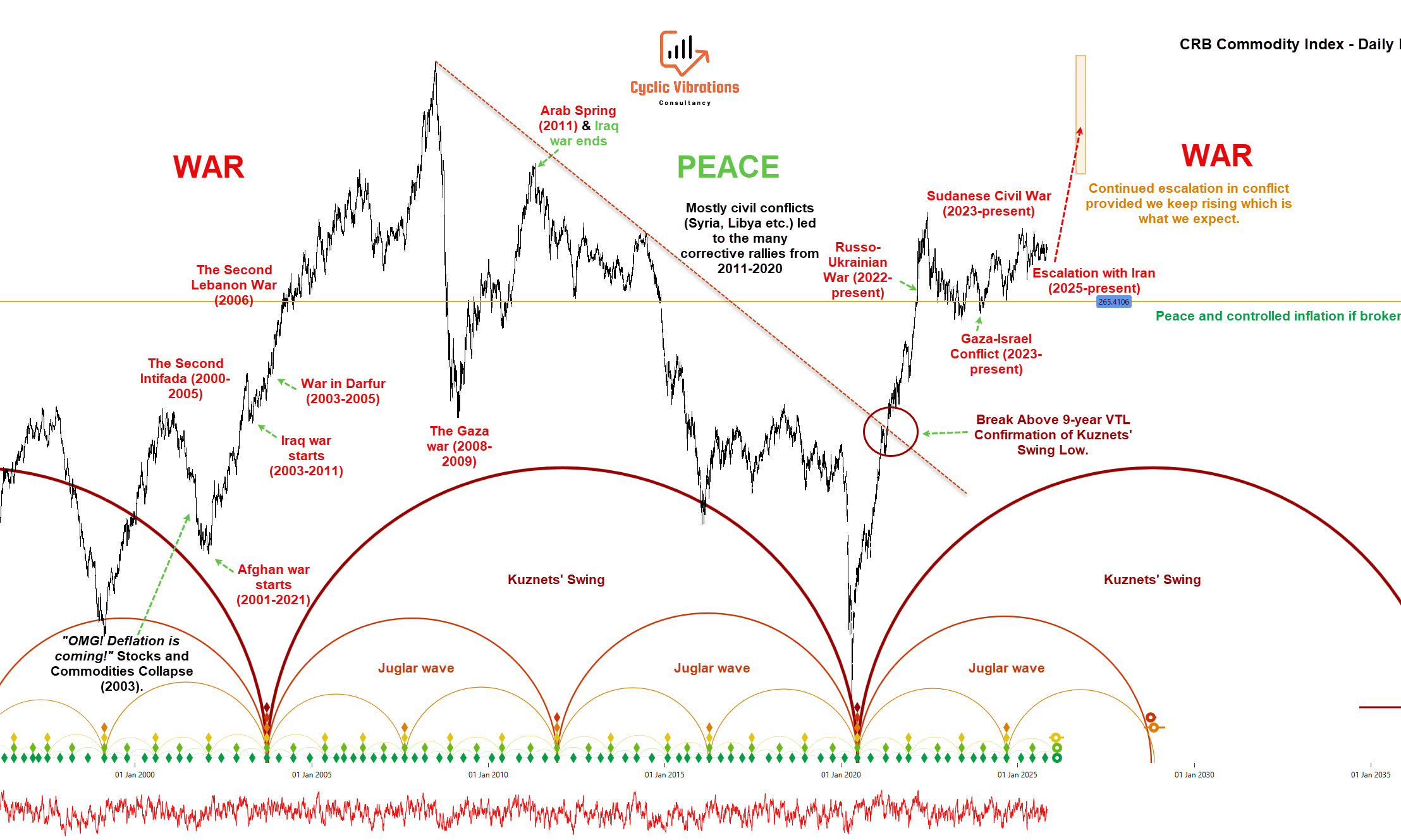

Read moreCycles of Conflict: Prophecy, Commodity Waves, and the post ~2055 Global Threat

The statement outlines a cyclical view of history using the Kondratieff Wave theory, predicting significant conflict and instability around 2055, referencing past events as analogues. This suggests a prolonged global conflict culminating in the restructuring of power, particularly in the Middle East, lasting until around 2095, followed by peace.

Read moreHurst Cycles Update (S&P 500, US Dollar, Gold, CRB Index, Interest rates, Bitcoin)

The video “The Market Cycle Update” discusses prevailing trends in major asset classes including the S&P 500, US Dollar, Gold, CRB Index, and Bitcoin. It forecasts significant sell-offs in equities and Bitcoin before expected troughs, bullish outlooks for Gold and commodities, and rising interest rates for the foreseeable future.

Read moreContact us

Feel free to contact us with any of your enquiries. We are happy to answer any of your questions in a prompt manner!