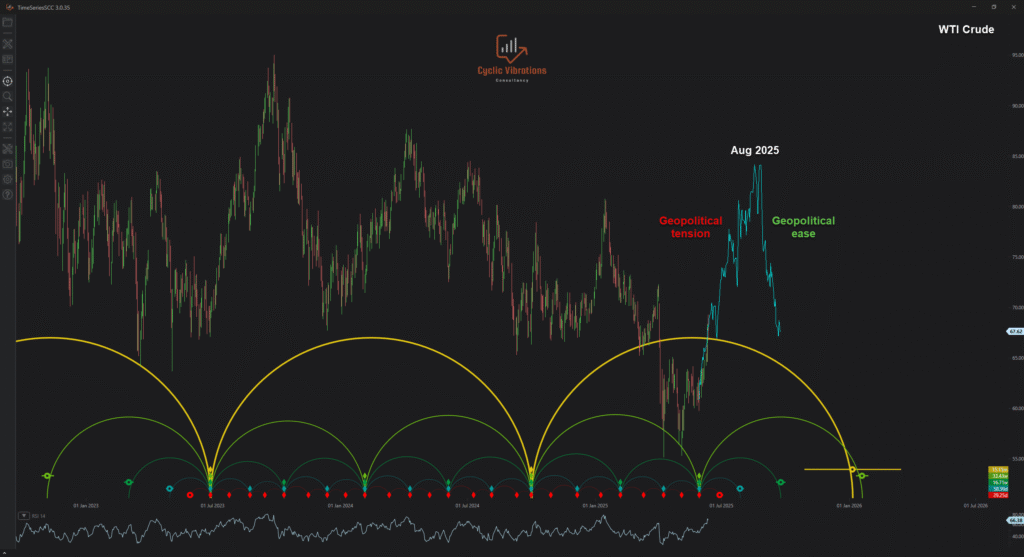

The reaction of crude oil after confirming the 40 week price wave’s low.

We have been warning clients of a significant advance in the price of crude oil, likely to occur in January 2025, after this instrument confirmed the Kitchen cycle low. We experienced a straddle to the left in terms of crude, as the Kitchen cycle low was briefly broken during the first 40-week correction due to President Trump’s tariff policies. We were confident that the advance was still likely, as we had recently started a new Kitchen cycle, which has an average length of 51 months; hence, we did not expect its price peak to occur this early in the cycle. The fact that we have a fundamental explanation for the false break makes the straddle to the left interpretation highly likely.

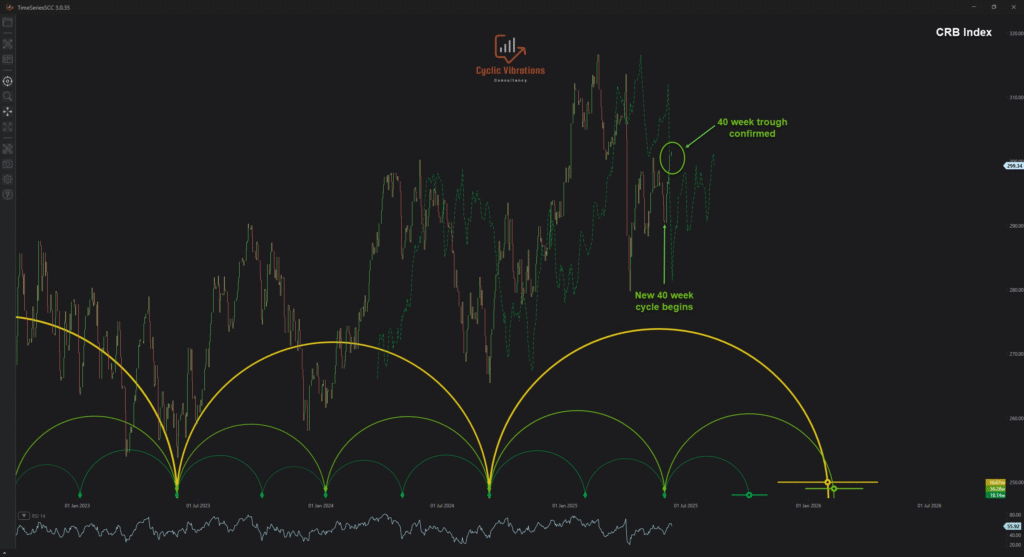

We also tweeted about an increase in geopolitical tension on the 23rd of May due to our bullish view on the CRB index, since almost all upswings in this commodity index are accompanied by an increase in geopolitical tension and warfare. We did not predict a specific conflict; instead, we anticipated a continuation and intensification of global warfare. The reason we have come to this conclusion is the confirmation of the 40-week price wave trough on the CRB index, which has formed a higher low rather than a lower low, as seen in the price of crude oil. This further supports our hypothesis of a straddle to the left in the price of crude, given the principle of commonality and its phase similarity to the CRB Index.

Presented above is a daily plot of the CRB index. We began our coverage of this index since the 54-month cycle trough has been confirmed via a break above the 18-month valid trendline. When a valid trendline is broken, it provides a strong indication that the price wave one degree larger than the wave on which the valid trendline is based has formed a peak or a trough in the recent past. The break above the 18-month valid trendline suggests that the 54-month price wave (Kitchen economic wave) has seen its trough before the break, and a new business cycle has begun. In April, we initiated a series of tweets anticipating a trough in a 40-week price wave on the CRB index. We expected further pressure until late May, which is where the mean period of the 40-week wave projected off of the latest 40-week trough took us. In April, we knew, based on our phasing, that we were in the final 20-week cycle of the current 40-week cycle. This is why we used the 20-week price wave’s FLD to confirm that this final 20-week cycle has terminated. The image presented confirms that we received confirmation on June 10th, indicating that we have likely begun a new 40-week cycle, projected to exceed the February high of 316. All this was presented to our Twitter followers in real time as this trough was unfolding. The reaction to this confirmation on the price of crude oil was theatrical, to say the least. We expect a continued rise in geopolitical tensions and warfare until we reach the peak of the first 18-month cycle of the current Kitchen cycle, which is scheduled to occur late August 2025 or beyond. We will closely follow this movement and alert our clients to any new developments.

Thank you for your valuable time.

CVC research team.