Forecasting Gold Prices: Insights from Kuznets and Kondratieff

Introduction

CVC Financial’s predictive model correctly anticipated Gold’s price surge after the December 2015 bear market low. This insight stemmed from applying the position within the Kuznets’ Swing and the application of the Economic Wave Theory, treating the 2015 low as the cyclical equivalent of the August 1999 trough. CVC published their prediction concurrently with the 2015 low, hypothesising the subsequent price movement would mirror the post-1999 trajectory. This prediction proved highly accurate, showing a 0.95 (95%) correlation between the two periods after cyclical normalization, indicating a near-identical structural market relationship.

Utilising the past to forecast the future

Based on a simplified application of the Kuznets’ periodicity, and drawing from the analytical framework mentioned earlier, the year 2008 is calculated as the analogous year for 2025.

🎯 Core Implication

This estimation provides a rough approximation of the current market’s position (2025) within the broader Kuznets cycle using the historical pattern established by the application of the Economic Wave Theory, suggesting that the structural market relationship in 2025 might roughly mirror that of 2008.

⚠️ Caveat

This is a simplified projection that disregards the nuances of cycle variation (the principle of cyclical variation was taken into account in our prior calculations that led to the 0.95 correlation). It serves only as a useful, albeit basic, long-range approximation.

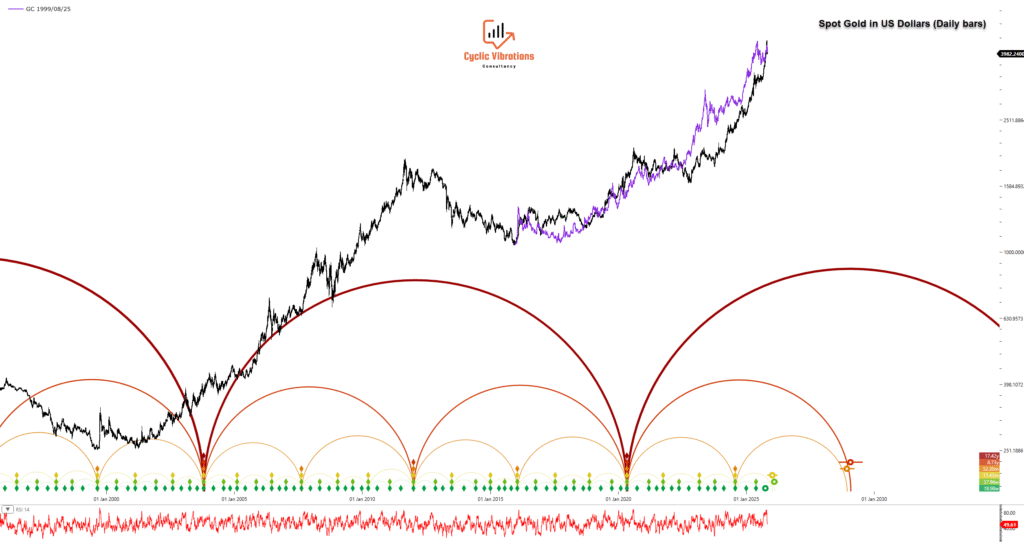

Figure 1

Empirical Validation and Extended Projections: The Path to Mania

The successful Kuznets’ Swing analogue allowed for an extended projection of Gold’s trajectory. As shown in Figure 1, our model confidently forecasted a renewed, multi-year Gold appreciation which we had been forecasting since mid-2016.

The projection wasn’t just about a cyclical recovery; it reflected a strong conviction in an impending “mania” phase for precious metals similar to that which occurred into 2011. By our proprietary metrics, the analogous phase to the zenith hasn’t been reached yet. This belief was intrinsically linked to a corresponding thesis on fiat currency debasement.

Anticipating the Dollar’s Decline

The analytical framework correctly predicted both the rise in Gold and a subsequent secular decline in the US Dollar (USD). This dual forecast highlighted the inverse relationship between stores of value (Gold) and reserve currencies (USD) during expansionary monetary policy. CVC’s correct foresight regarding this shifting financial landscape was publicly confirmed by a disseminated tweet.

The post-2015 Gold trajectory strongly validates the Economic Wave Theory’s predictive power. This theory offers a robust framework for anticipating both asset class movements (Gold) and the underlying macro-currency shifts (USD).

The Implied Reversal: Dollar Devaluation and the Ascent of Precious Metals

The established negative historical correlation between the US Dollar Index (USDX) and precious metals is central to our future outlook.

🔑 Core Conclusion

Leveraging our robust Kuznets’ Swing cyclical interpretations, we confidently assume the foreseeable future will feature the sustained appreciation of precious metals concurrent with the secular depreciation of the US Dollar. 📉💰

CVC rigorously established the divergence (Gold appreciating while USD depreciating) using the Similar Cyclical Circumstance (SCC) principle inherent to the Kuznets’ Swing. This framework provided a powerful, empirically validated lens for pattern recognition and market forecasting.

Escalating Analytical Rigour: The Kondratieff Analogue

The predictive thesis will now be refined using the Kondratieff Wave cyclical position, utilising the available long-term data for the US Dollar and precious metals.

📈 Analytical Strategy

The Kondratieff analogue is expected to yield a higher and more robust correlation than the shorter Kuznets’ Swing. This move strategically escalates analytical rigour, using larger cyclical patterns to:

- Affirm the existing forecast.

- Potentially refine the magnitude and timing of anticipated market shifts.

The convergence of two distinct, long-wave cyclical positions (Kuznets and Kondratieff) significantly strengthens the conviction behind the predicted structural reversal in these key asset classes.

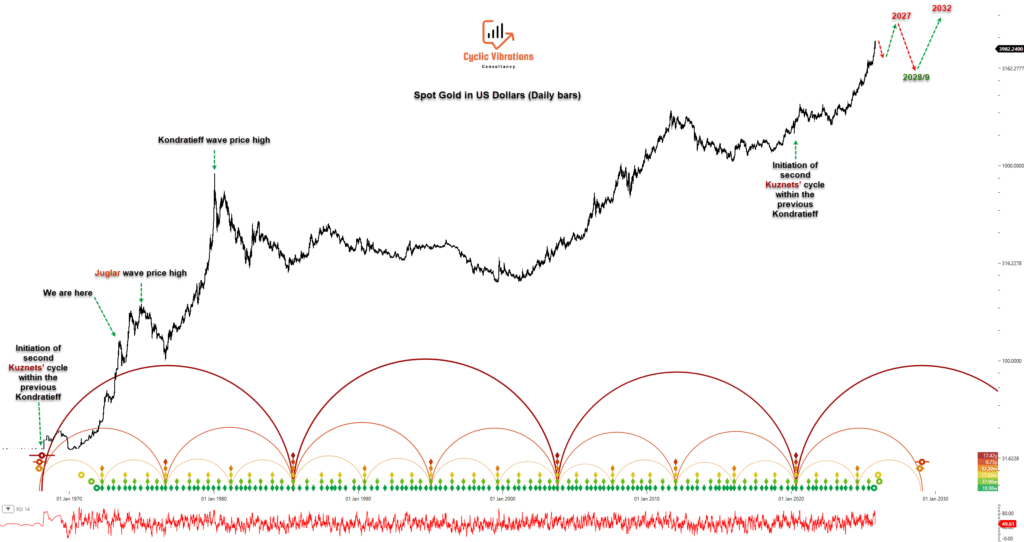

Figure 2

The Echo of the 1970s: Forecasting the Post-2020 Environment via the Kondratieff Wave

Since 2016, CVC has consistently alerted clients to a looming structural environment post-2020 that is remarkably similar to the 1970s. This pivotal forecast is grounded in the Kondratieff Wave theory, which identifies the 1970s as the precise historical analogue.

Our long-wave analysis asserts that the 2003 global low initiated a new Kondratieff cycle, analogous to the 1949 historical trough.

Furthermore, the base (first) Kuznets’ Swing within this current Kondratieff cycle terminated at the COVID-19 pandemic trough in 2020.

The critical analogous trough to 2020 is that of 1968.

This inflection point catalyzed a significant 12-year advance in precious metals and an equally protracted 12-year decline in the US Dollar (USD). This trend only reversed upon the final bursting of the precious metals bubble in 1980.

Cyclical Chronology and Forward Projections

Assuming that the Principle of Variation has not yet introduced significant period divergence, we can establish a precise forward-looking chronology for the current cycle based on the 1968 analogue.

| Historical Event (Analogue Cycle: 1968 Start) | Historical Date | Duration (Years) | Projected Date (Current Cycle: 2020 Start) | Event Significance |

| Juglar Cycle High (Precious Metals) | 1974-1975 | approx 7.0 | 2026-2027 | Projected Juglar Cycle High |

| Juglar Cycle Low (Corrective Phase) | Late 1976 | approx 8.5 | 2028-2029 | Projected Juglar Cycle Low |

| Analogous Price Peak (Precious Metals/Kondratieff High) | 1980 | approx 12.0 | 2032 | Projected Kuznets Wave High |

With five years elapsed since the current Kuznets’ Swing began in 2020, our current cyclical phase is analogous to 1973 (1968 + 5 years).

📈 Near-Term Implication

This analogue suggests that following a probable, near-term corrective leg lower (to be analyzed further), precious metals are poised to resume their ascent, targeting new highs into the anticipated Juglar wave peak in 2027.

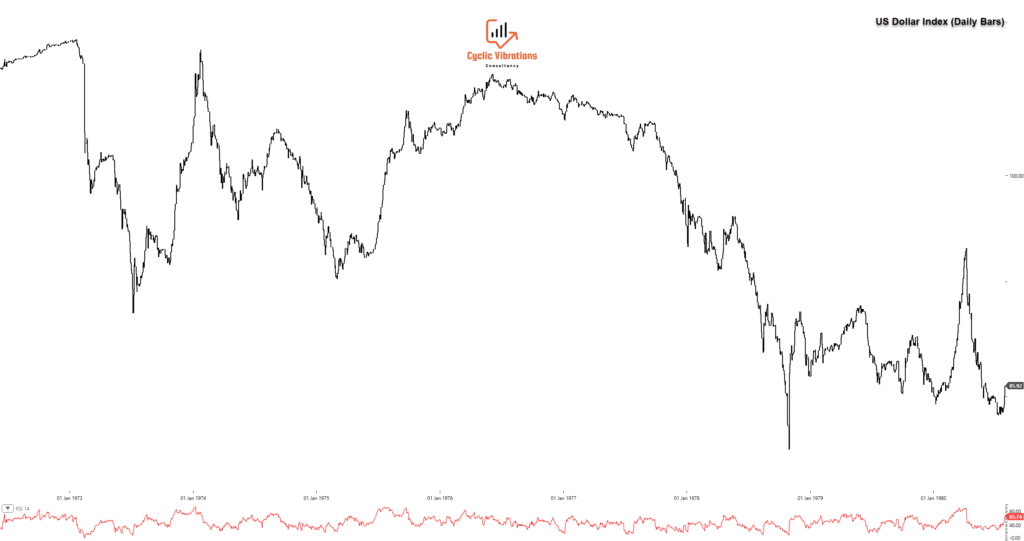

The Dollar’s Parallel Path

Based on the interwoven cycles, this analysis implies the US Dollar Index (USDX) action will structurally mirror the period from 1973 to 1980.

📉 USD Forecast & Roadmap

This historical analogue suggests a sobering expectation for the USD’s performance, reinforcing the central thesis of sustained Dollar decline until the final cycle peak of precious metals around 2032.

The convergence of the Kuznets’ and Kondratieff frameworks thus provides a highly detailed, decade-long roadmap for the inverse performance expected of precious metals and the global reserve currency.

Figure 3

The Phoenix Effect: Projecting the Dollar’s Post-Mania Resurgence

Following the Bretton Woods collapse in 1971, the US Dollar Index (USDX) entered a secular bear market that culminated its major decline in 1980.

Crucially, the USD then experienced a sharp, vigorous rebound to new highs between 1980 and 1985.

The Cyclical Endgame: From Debasement to Reaffirmation

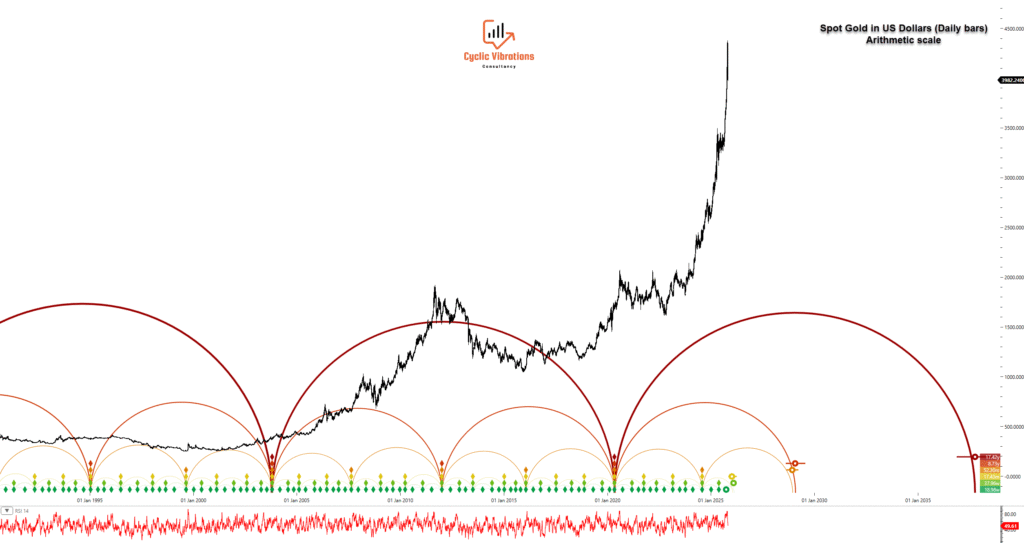

From the Kondratieff Wave analogue perspective, CVC projects a reoccurrence of the counter-trend USD resurgence in the coming decade.

📅 Projected Cycle

The analysis suggests the current cycle’s precious metals mania will climax around 2032 (analogous to 1980). This will lead to the subsequent USD rebound projected from 2032 to 2037 (analogous to 1980–1985).

🔄 Addressing the Conundrum: The ‘Phoenix Effect’

This forecast offers a critical nuance to the current, justified expectation of a significant deterioration in faith in the US Dollar (which fuels current Gold strength).

Once the precious metals bubble bursts and the cyclical mania concludes, the ensuing systemic shock and flight to safety is predicted to trigger a decisive reversal. Despite contemporary de-dollarization anxieties, the historical pattern suggests global capital will ultimately flock back into the US Dollar as the world’s most liquid safe-haven asset once high rates of interest on the USD finally tackle inflation. This projected ‘Phoenix Effect’ in the USD provides the final, dramatic act in the current Kuznets’ cycle.

Figure 4

Conclusion and Short-Term Outlook: The Unfolding Golden Zenith

The current Gold rally is remarkable and validates CVC’s long-wave cyclical analysis. However, based on Kondratieff Wave projections (ultimate mania phase around 2032), we assert the cyclical zenith has yet to be reached, and the most dynamic appreciation phase is still ahead.

📺 Short-Term Outlook & Refinement

While the long-term structural trend is firm, short-term volatility requires tactical analysis. Our forthcoming video will provide a detailed, short-term cyclical perspective on Gold and other instruments, focusing on identifying the immediate corrective leg lower and the subsequent resumption of the uptrend into the projected 2027 Juglar cycle peak.

This crucial update will bridge the long-wave strategic outlook with necessary short-term tactical entry and exit points.

Ahmed Farghaly

Founder & CEO of Cyclic Vibrations Consultancy (CVC)

Recent Comments