Our Current Position within the Fluctuations of the Cycles of History

Introduction

Building on our previous outline of Economic Wave Theory (EWT), this report situates the current economic environment within its global cycles, illustrating them through historical analogues. The phases of these waves exhibit remarkable synchronicity across most economies.

The Kuznets Economic Wave

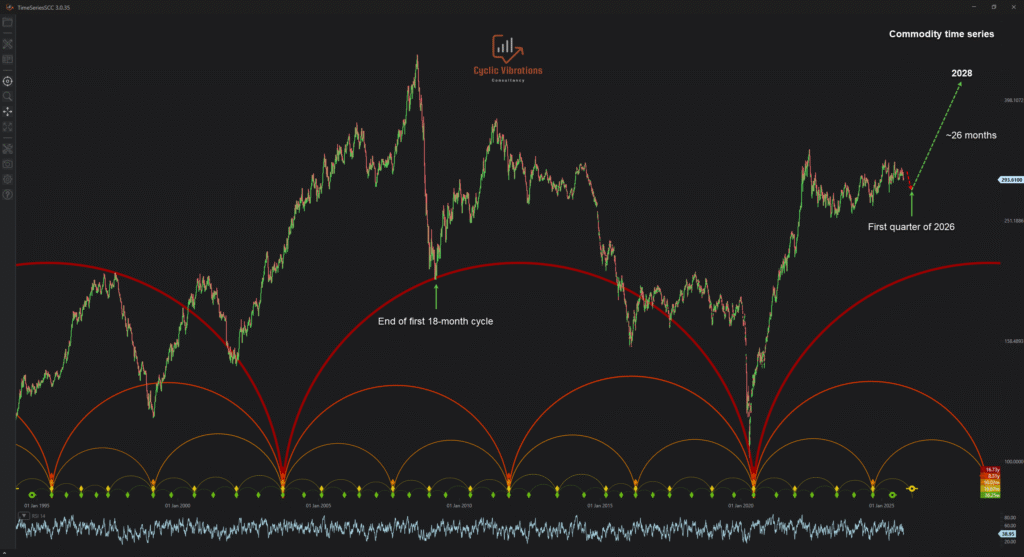

The most recent Kuznets trough occurred between March and June 2020, placing the current phase at approximately 5.33 years. The prior trough in 2003, following SARS, suggests that the post-2020 environment may parallel the earlier expansion. Since 2020, equities and commodities have advanced sharply alongside rising inflation, consistent with historical post-trough patterns, while commodity upswings coincide with geopolitical tensions, as seen in Ukraine and Gaza.

The current Kuznets phase aligns roughly with late 2008. The absence of a GFC-like downturn reflects Hurst’s principle that exogenous disruptions need not recur. The analogous Kitchin cycle (54-month wave starting Q3 2024) would likely peak in its second 18-month subcycle (based on the Kondratieff analogue), around 2027, rather than the third (based on the Kuznets’ analogue). Following the unadjusted Kuznets swing, the commodity index is projected to rise from Q1 2026 and into 2028 before the first Juglar-wave correction.

Figure 1

The Kondratieff Economic Wave

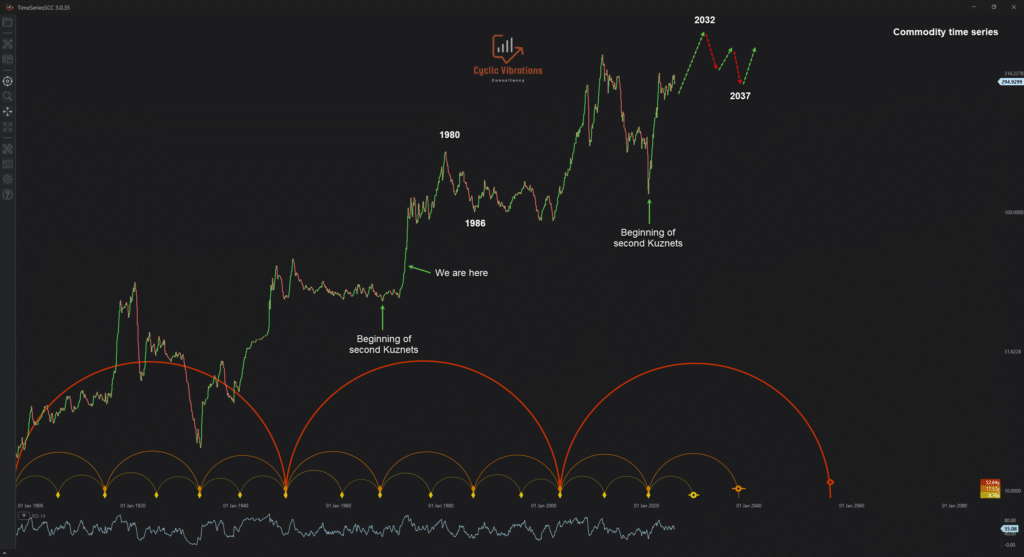

The Kondratieff trough occurred in March 2003, placing the current phase at 22 years and 7 months, within the second Kuznets cycle of the long wave—the “summer” season—explaining post-2020 inflation. Its historical analogue (1968) implies the current Kondratieff position corresponds to 1973. That analogue saw major events including Bretton Woods’ collapse, the 1973 oil embargo, the Yom Kippur War, rising gold, and a weakening US dollar, paralleling current trends in inflation, currency, gold, and market volatility.

The historical summer peak occurred in 1980, seven years after 1973; projecting forward, the current summer-season peak is expected around 2032, with the corresponding Kuznets peak likely during the second sub-cycle of the next Juglar wave. A 5–6-year correction into 2037 is anticipated, followed by commodity recovery marking the Kondratieff “fall” season, with disinflation and equity bubbles, before winter deflation drives declines in commodities and equities.

Figure 2

The Hegemonic (Jared) Economic Wave

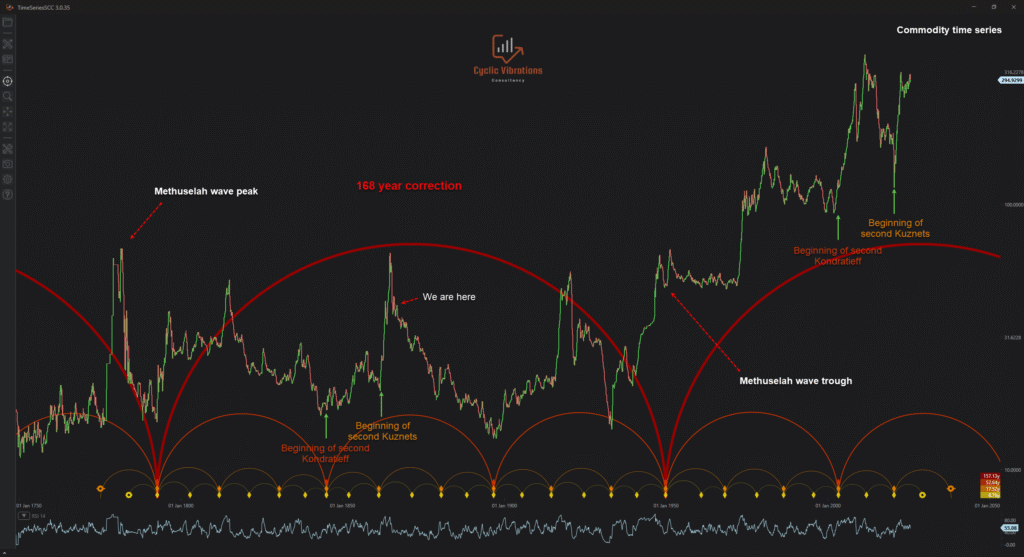

The hegemonic trough of July 1949 places the current phase at 76 years and 3 months, within the second Kondratieff cycle of the hegemonic wave (“summer” season). The 2003 Kondratieff cycle finds its analogue in 1843–1896, with the first Kuznets swing (1843–1861) correlating well with the current cycle’s first Kuznets swing (2003-2020). The 1861 low that triggered the U.S. Civil War parallels the 2020 low, initiating today’s polarisation crisis.

While current circumstances are less severe, significant political and social divisions emerged earlier than anticipated during the fifth Kuznets swing. Projections from this wave are more bearish than other analogues, reflecting its context within the second hegemonic cycle nested in the larger Enoch wave. The 1781 peak belonged to a still larger cycle, historically preceding a 168-year technical bear market. Given differing trends today, the 1949 low likely represents a major long-term trough, supporting further upward progression.

Figure 3

The Enoch Economic Wave

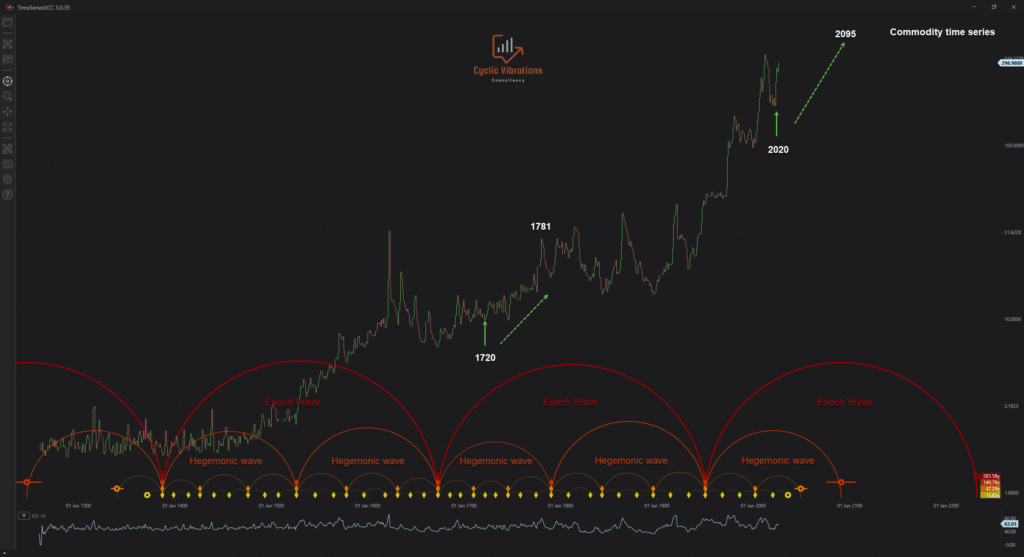

The Enoch trough of July 1949 marks a phase of 76 years and 3 months. Its historical analogue (1673) implies a 276.8-year cycle. Post-1792, cycle lengthening caused the preceding hegemonic cycle to be 157.13 years; with variation adjustments, the current Enoch cycle is expected to span 314.26 years.

The 2020 trough, beginning the fifth Kuznets swing, corresponds historically to 1720, after which commodities rose for 61 years, peaking in 1781. Lengthened cycles suggest the current rise will extend longer, with the peak projected near the turn of the century. This implies long-term inflationary trends and sustained commodity strength, reinforcing the likelihood of ongoing geopolitical tension, while seasonal corrections continue within hegemonic and Kondratieff waves.

Figure 4

Conclusion

All cycles, except the hegemonic wave, indicate future commodity appreciation. The 18-year cycle projects a 26-month rally, the Kondratieff wave anticipates gains into 2032, and Enoch’s wave suggests a rise toward century-end. The hegemonic wave projects a negative outlook, reflecting historical corrections, but the current trend differs from the analogue, with constituent cycles likely reaching higher peaks.

General inflation is expected through 2032, followed by a commodity correction from 2032 to 2037. The Enoch wave indicates the current uptrend is still in its early stages, with the ultimate peak at century-end. Historically, rising commodity prices correlate with geopolitical tensions. Finally, the last Kuznets swing of the current hegemonic cycle that is expected near the turn of the century may trigger severe disruption, leading to the fall of an old-world order and the rise of a new one.

Ahmed Farghaly

Founder & CEO of Cyclic Vibrations Consultancy

Recent Comments