How CVC correctly anticipated the recent advance in commodities and an escalation of conflict.

CVC closely follows commodity prices, as their advance is often due to an increase in conflict and global warfare, which is something we are interested in predicting here at CVC. We have long held the view that commodities are likely to increase in the long term into the next decade, which translates to a troubled geopolitical climate until commodities approach their peak. We hypothesized that this multi-year advance would likely occur in stages, the dates of which we are willing to share upon consultation regarding the commodity index. We initiated a series of tweets regarding the CRB index, which accurately guided traders as this commodity index formed its trough and began its ascent. The tweets are pasted below:

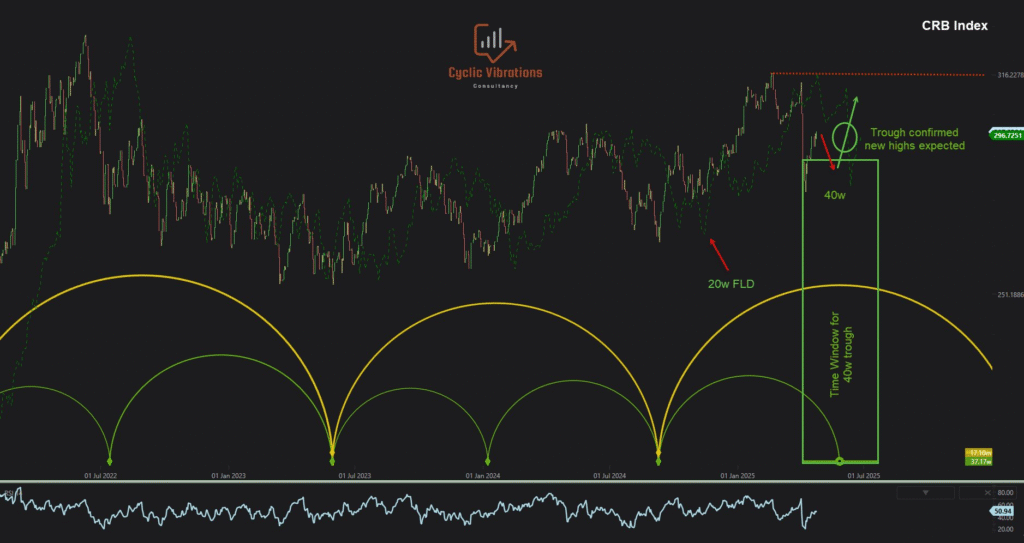

April 25th 2025

Inflation: We have entered a time window where we would expect a trough of the 40-week price wave (current average period = 37.17 weeks) in the price of the core commodities index. A positive intersection with the FLD that is based on the 20-week wave would confirm that the trough has occurred. It would project a new high relative to the 316.63 high experienced on the 19th of February 2025 based on cycle theory.

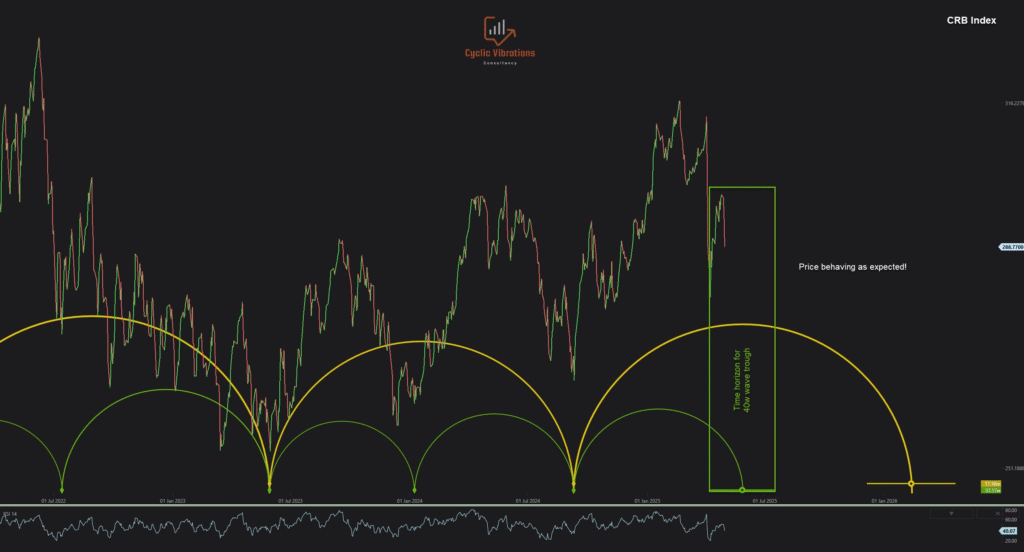

May 1st 2025

May 23rd 2025

The time has come for a renewed rise in commodities. Given the historical correlation between an upswing in commodity prices and increased geopolitical tension, we can expect continued and heightened geopolitical tension until we reach the peak of the current 18-month cycle, which we anticipate sometime in August 2025.

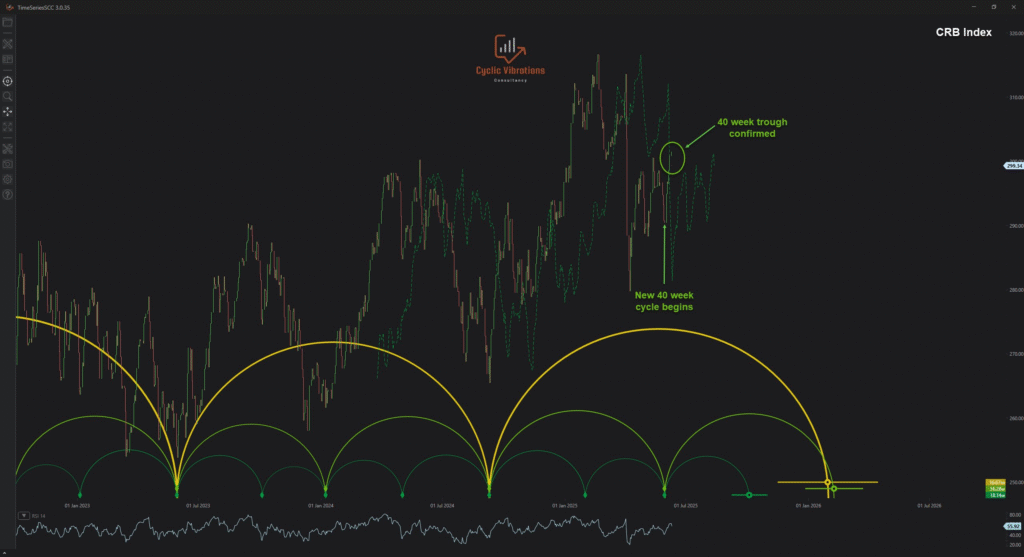

June 10th 2025

Confirmation of the bottom on the CRB index, we expect the advance that kicked off in September 2024 to continue to new highs.

As presented above, CVC accurately described the price movement on the CRB index from April 25th to date. We correctly anticipated the termination of the corrective price movement since February 2025 and accurately predicted the resumption of the bull market to reach new highs. CVC also accurately anticipated an escalation of conflict and global warfare on May 23rd, 2025, weeks before the escalation of the war in the Middle East. The Economic Wave Theory enables us to forecast most financial instruments with astounding accuracy. Given that commodities rise primarily due to increased conflicts, the Economic Wave Theory enables its practitioners to forecast geopolitical conflicts with unmatched accuracy ahead of time. We have an exciting outlook for the future of commodity prices, which we are willing to share with clients upon request via our consultation services. The future is full of opportunities across all asset classes, not just commodities. Do not miss out on the chance and book a consultation with one of our analysts today!

Thanks for your time,

CVC research team

Recent Comments