Imminent Peak and Long-Term Risk: S&P 500 via Economic Wave Theory

Introduction

This article presents a high-confidence outlook on the S&P 500 based on the Economic Wave Theory. We analyze the clear cyclical structure across long-term (Kuznets, Kondratieff) and medium-term perspectives, noting general adherence to the principle of commonality with expected variations, as will be presented once we tackle other instruments in the future.

S&P 500 Long-term Cyclical Outlook

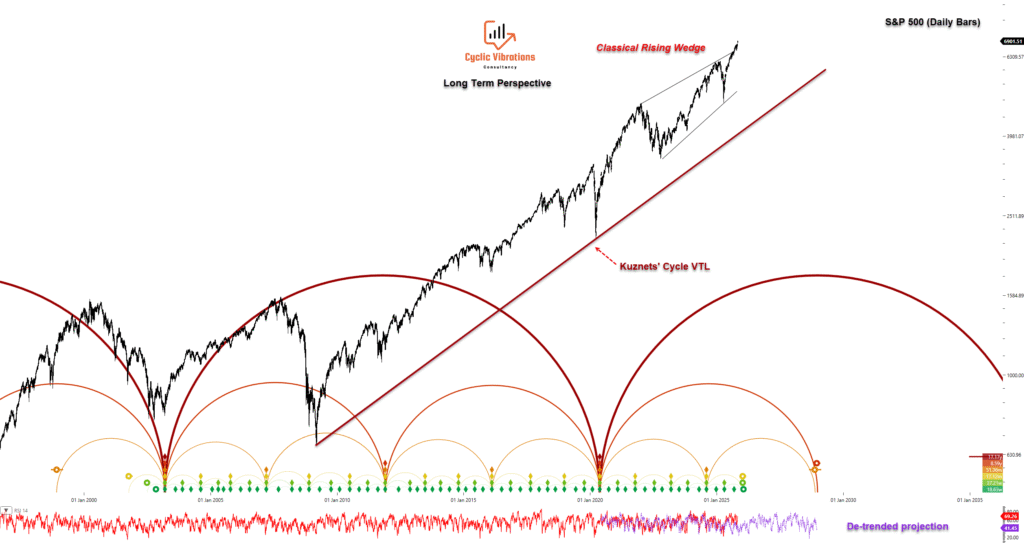

Figure 1

Our long-term analysis (Figure 1) confirms the S&P 500 is in a new Kondratieff Wave that began with the 2003 trough.

This initial phase was complicated —an exogenous force creating a “straddle to the left” (CVC term)—which briefly broke the 2003 low in the Global Financial Crisis (GFC).

The first Kuznets cycle of this Kondratieff Wave ended at the COVID-19 pandemic low in 2020.

We are currently in the second Kitchin cycle of the first Juglar cycle within the newly initiated Kuznets swing.

The Valid Trend Line of the Kuznets cycle is a crucial support level to monitor when the market undergoes a corrective phase toward a projected trough in 2028/2029 to then initiate the second Juglar cycle in the current Kuznets’ swing.

From a classical technical analysis perspective, a rising wedge pattern is clearly evident on the S&P 500 on log scale since the 2020 price low. As one of the most bearish formations, this pattern typically forecasts a complete retracement back to its starting point (2020).

S&P 500 Medium-term Cyclical Outlook

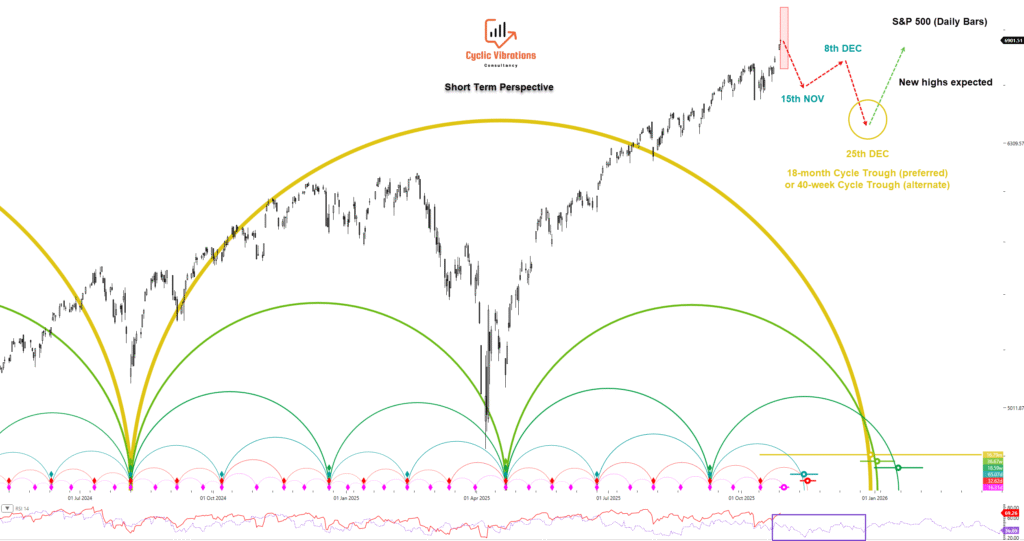

Figure 2

Based on structure and the principle of commonality, we believe a new Kitchin cycle began on August 5, 2024.

We dismiss the April 7th low as the start of the Kitchin cycle, suspecting a “straddle to the left“—a fractal echo of the 2008 event. We are expecting a three-wave sell-off as presented in the image once the expected peak is formed. We expect a rebound around the 15th of November, which will mark the end of the current cycle of the 80-day wave, followed by a corrective price rally into the 8th of December, forming the peak of the final 80-day cycle, which should be followed by renewed pressure till year-end.

Current Position and Peak Projection

We are currently in the final 20-week cycle of the present 18-month swing.

- Final Peak Projection: Due to the strong time translation observed, the peak of the 18-month cycle (preferred) or 40-week cycle (alternate) is likely to occur within the current 40-day price wave.

- Micro-Structure: We are specifically in the second 40-day cycle of the first 80-day cycle within that final 20-week swing.

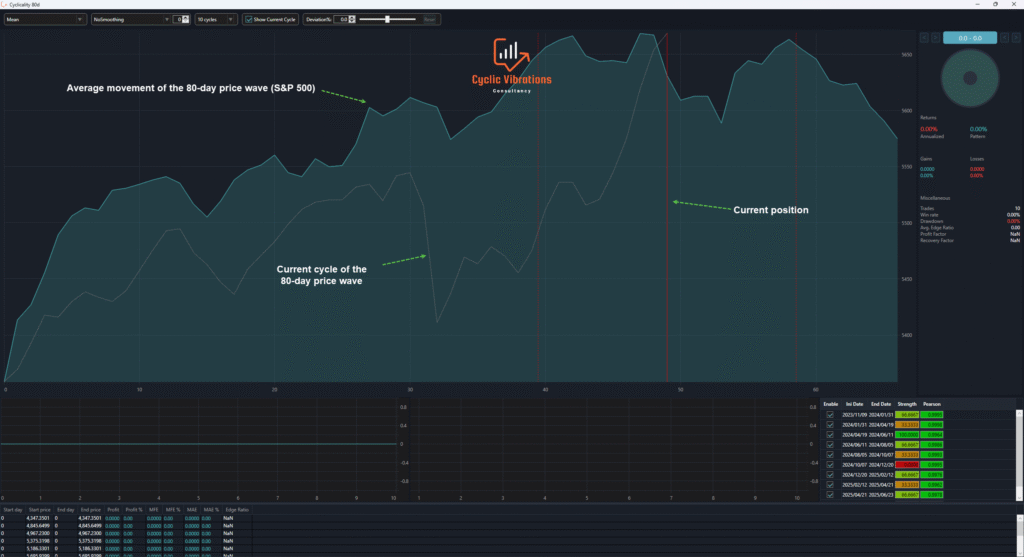

- Amplitude Analysis: The current 40-day cycle’s amplitude has already exceeded its 2023-2025 calculated mean.

- Peak Implication: Given the excess amplitude and its position as the second 40-day cycle, it is likely nearing its peak. This suggests the 80-day cycle is also forming its peak.

- Final Peak Projection: Due to the strong time translation observed, the peak of the 18-month cycle (preferred) or 40-week cycle (alternate) is likely to occur within the current 40-day price wave.

Figure 3 (80-day cycle approaching its peak)

🎯 Concise Conclusion: Near-Term Peak, Long-Term Risk

Our high-confidence Economic Wave Theory analysis projects an imminent near-term peak for the S&P 500, signaling the probable peak of the 18-month cycle.

Key Takeaways

- Near-Term Peak: The 40-day cycle’s excessive amplitude confirms the peak of the 80-day cycle is forming now, which should coincide with the peak of the 18-month cycle (or the 40-week). A structural reversal is likely imminent.

- Long-Term Risk: The S&P 500 faces significant risk from both the bearish rising wedge pattern (targeting the 2020 low) and the corrective phase of the long-term Juglar economic wave, which projects a major trough in (2028/2029).

In summary, both cyclical timing and classical technical signals point to a critical, high-probability turning point right now, preceding a period of significant structural decline till year-end, followed by a significant recovery as this market begins a new 18-month (or 40-week) cycle early next year.

Ahmed Farghaly

Founder & CEO, Cyclic Vibrations Consultancy

Recent Comments