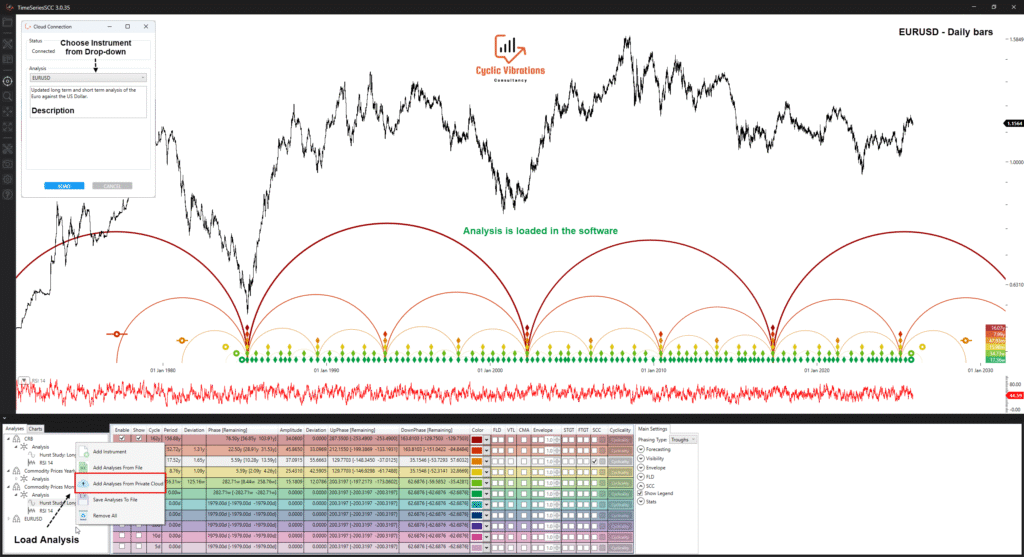

CVC’s Analytical Cloud Service

TimeSeriesSCC owners can enhance their market analysis through a subscription to the Analytical Cloud. This platform provides immediate access to a curated workspace with 30 analytical files for various financial instruments, allowing full customization and real-time analysis. New purchasers also receive a complimentary annual subscription bundled with their software.

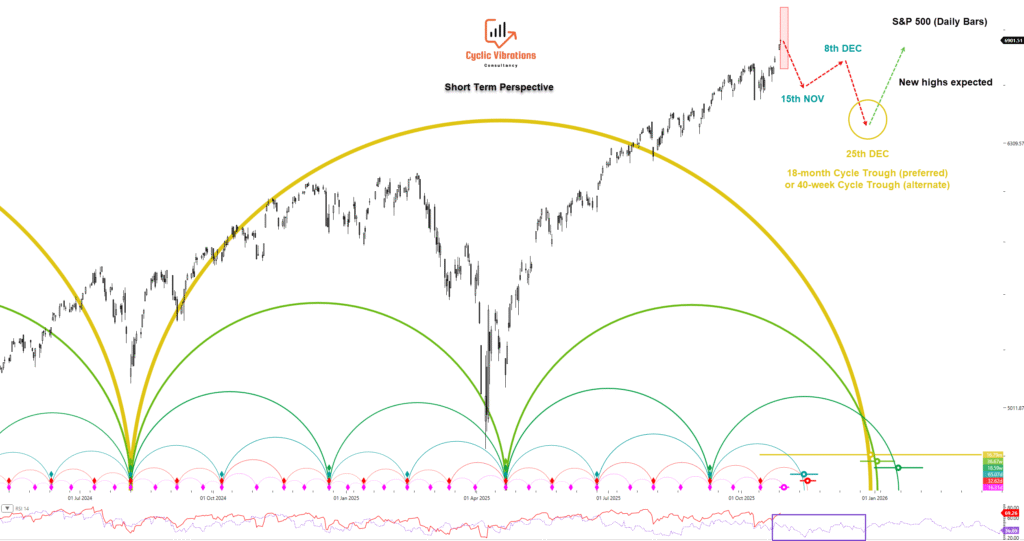

Recent Comments