TimeSeriesSCC: The Data-Driven Path to Validated Seasonal and Economic Trading Strategies

Unleash the full power of proprietary financial insight with TimeSeriesSCC.

Developed directly from the groundbreaking Economic Wave Theory pioneered by our consultancy’s founder and CEO, TimeSeriesSCC is more than just a software—it’s a digital translation of proven expertise. Unlike automated black-box solutions, TimeSeriesSCC places complete analytical control directly in your hands. This allows you to rigorously apply our exclusive theories to your financial decisions, ensuring that decisions are driven by expert methodology, not opaque algorithms.

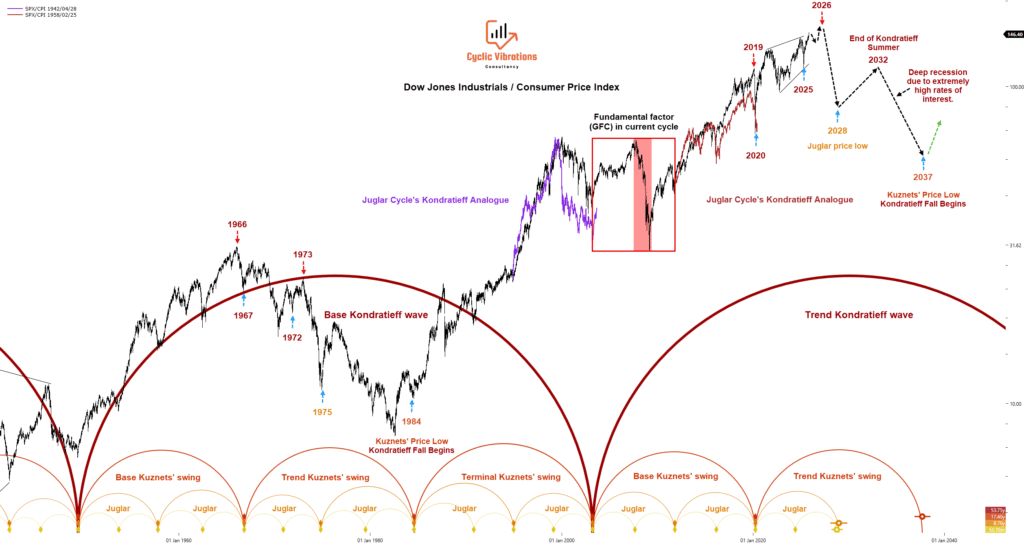

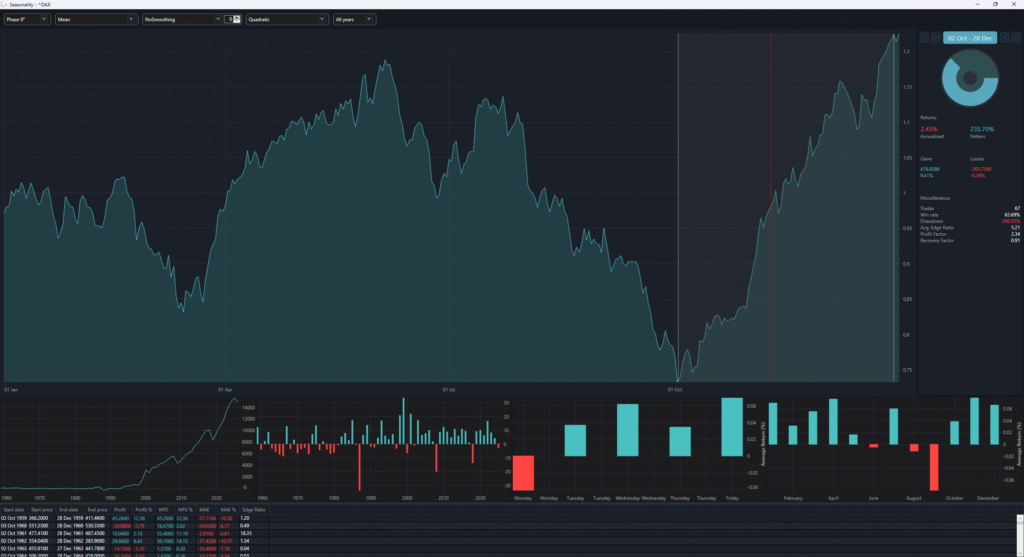

Output on the DJIA in real terms on TimeSeriesSCC

🚀 TimeSeriesSCC: Precision Forecasting Through Proven Cycle Analysis

TimeSeriesSCC is the indispensable investment software for the professional analyst.

At its core, the software translates complex cycle theory into actionable intelligence. By conducting a formal phasing analysis, users can precisely determine their current position within multiple, overlaid market cycles. This critical step allows you to identify the specific phase of the cycle of repetition, making it possible to construct highly reliable forecasts based on historical analogues.

TimeSeriesSCC is not a tool for the casual investor; it requires and rewards expertise. Users must be formally trained in both cycle theory and phasing analysis to harness its full predictive power, which is provided in our 8-hour training course

The Forecasting Advantage:

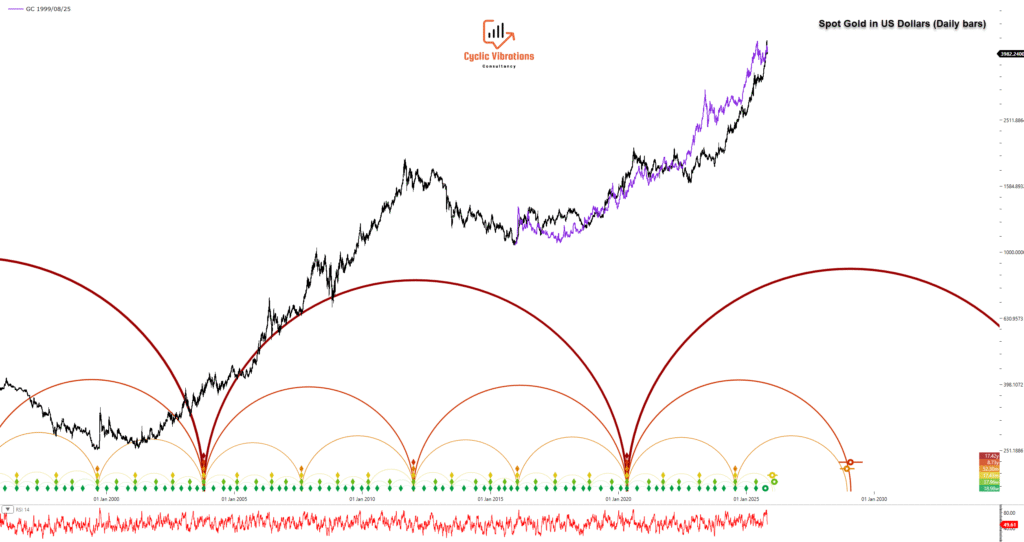

As evidenced by the compelling results visible in the chart (e.g., the Kondratieff cycle analysis shown in the image), our methodology consistently yields high out-of-sample correlation. This exceptional alignment between historical analogues and current market positioning provides a robust, proven foundation for constructing highly accurate, confidence-backed forecasts—turning complex patterns into a clear strategic edge.

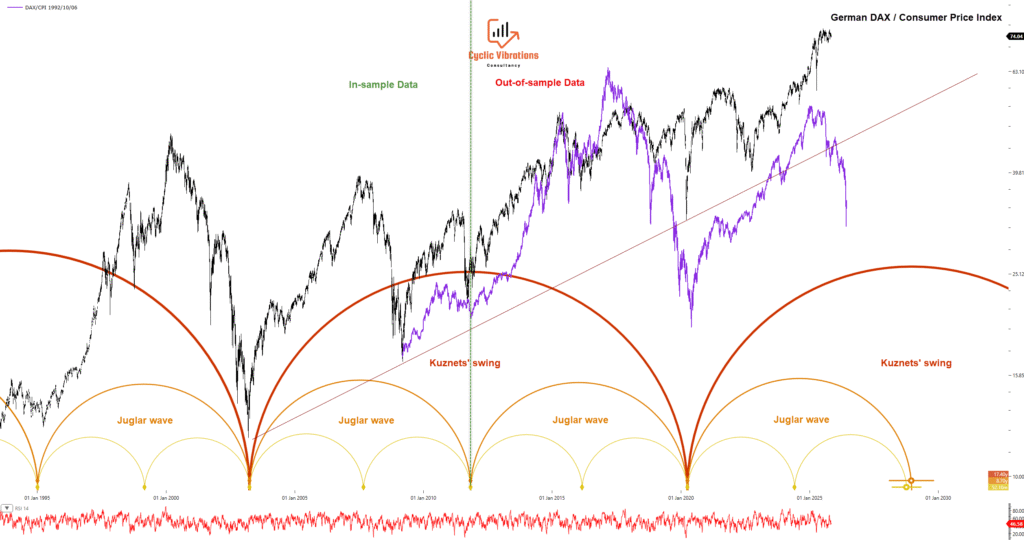

Application of the Economic Wave Theory on the German DAX adjusted for inflation

📈 Unprecedented Predictive Power: The TimeSeriesSCC Advantage

The results speak for themselves: Our phasing analysis delivered an out-of-sample correlation coefficient exceeding 0.8 on the German DAX.

This level of correlation, derived from the 18-year cycle analogue, demonstrates the exceptional predictive accuracy of the Economic Wave Theory.

The Key to Precision Trading

It is crucial to understand that identifying a major cycle (like the 18-year or 54-year cycle) is not about adopting a new trading timeframe; it is about establishing a powerful strategic context.

Instead, the position determined by the long-term cycle provides a high-confidence directional bias that guides trades on shorter, more volatile waves. For instance, we successfully leveraged the overarching influence of the 54-year cycle position to inform precise trading decisions based on minor cycle fluctuations within the projection, specifically the 20-day and 40-day price waves.

TimeSeriesSCC empowers the professional to combine the macro-stability of long-term cycles with the micro-opportunities of short-term swings, transforming high-level analysis into an actionable, medium-frequency trading strategy.

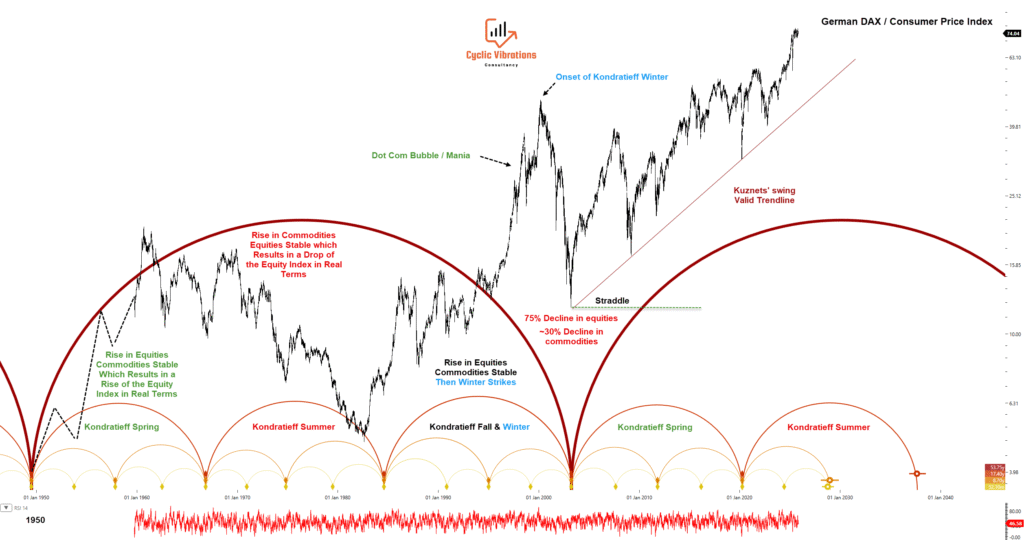

The Kondratieff wave on the German DAX adjusted for inflation

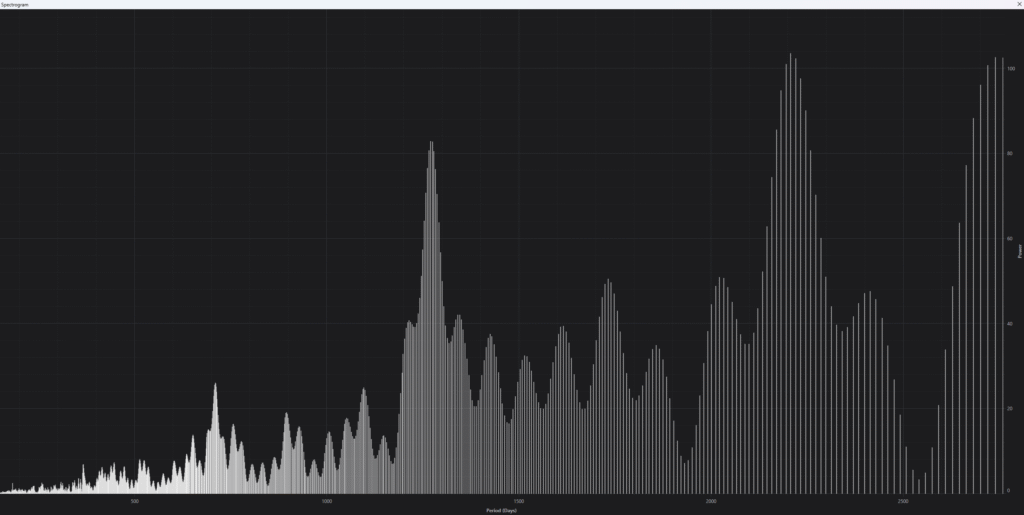

Spectral Analysis of German DAX

🔬Achieve rapid, deep analytical insight with our top-notch spectral analysis.

We utilize a simple, lightning-fast algorithm that delivers high efficacy without the computational drag of overly complex systems. This spectral analysis is the critical first step in establishing your initial cyclic model—the robust, calculated starting point essential for accurate formal phasing analysis.

Exclusive Training for Expert Application

While the software simplifies complex calculations, its power is fully realized through understanding its underlying methodology. Every step required for the software to calculate the current cyclic model is discussed in comprehensive detail within the exclusive training course, available only to owners of the TimeSeriesSCC platform. This commitment ensures you transition from software user to a fully informed, highly effective cycle analyst.

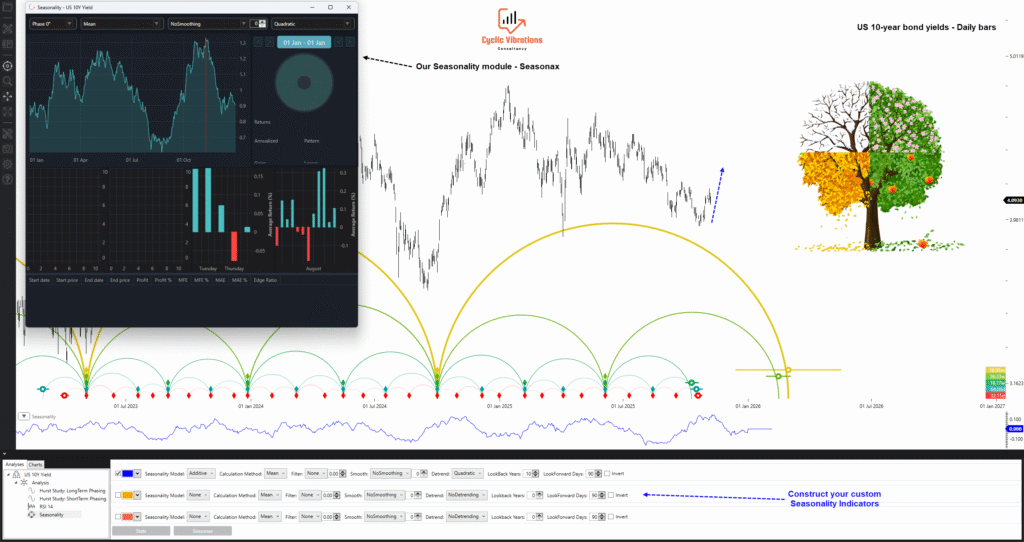

Build strategies based on seasonality

📅Unlocking Annual Cycle Alpha: Data-Driven Seasonal Strategies

Stop guessing about market seasonality. TimeSeriesSCC empowers you to build and rigorously test strategies based on the annual cycle, acknowledging that certain periods on the calendar are historically more beneficial for stocks, while others are not.

Precision Testing in Milliseconds

Forget manual backtesting. Our software allows you to instantly ask the computer to calculate historical performance by going long or short during specific, user-defined periods on the calendar.

Within milliseconds, TimeSeriesSCC delivers all the critical statistics that professional traders and investors demand for validation:

- Win Rate: Determine the historical probability of success for your seasonal strategy.

- Total Profit/Loss: Quantify the strategy’s historical financial efficacy.

- Recovery Factor: Assess the strategy’s resilience and ability to bounce back from drawdowns.

- and much more.

This unparalleled speed and precision ensure your seasonal strategies are not based on anecdote, but on validated, high-confidence historical data.

Create custom seasonality indicators and display them in an indicator panel

Build strategies based on Hurst Cycles

🔄Beyond the Calendar: Validating Strategies Across Any Cycle Length

The power of our seasonality module extends far beyond the annual calendar. TimeSeriesSCC gives you the unmatched flexibility to apply this rigorous testing framework to cycles of virtually any length, including advanced concepts like Hurst cycles, as demonstrated in our analysis.

Unlocking Multi-Year Opportunities

For instance, historical examination of the 54-month Hurst cycle reveals that going long near the current time (represented by the solid red vertical line) has been statistically and demonstrably beneficial. This is the level of high-confidence opportunity you gain. It is important to note that the principle of variation in cycle length is brilliantly taken into account in all calculations.

With TimeSeriesSCC, you can quickly conduct comprehensive statistical tests for trading strategies based on any identified Hurst cycle. As always, the system instantly processes the data and provides you with all the necessary statistics—including Win Rate, Profit Factor, and Recovery Factor—to confidently aid your final decision-making process. Leverage data, not guesswork, to exploit cyclical patterns at any timeframe.

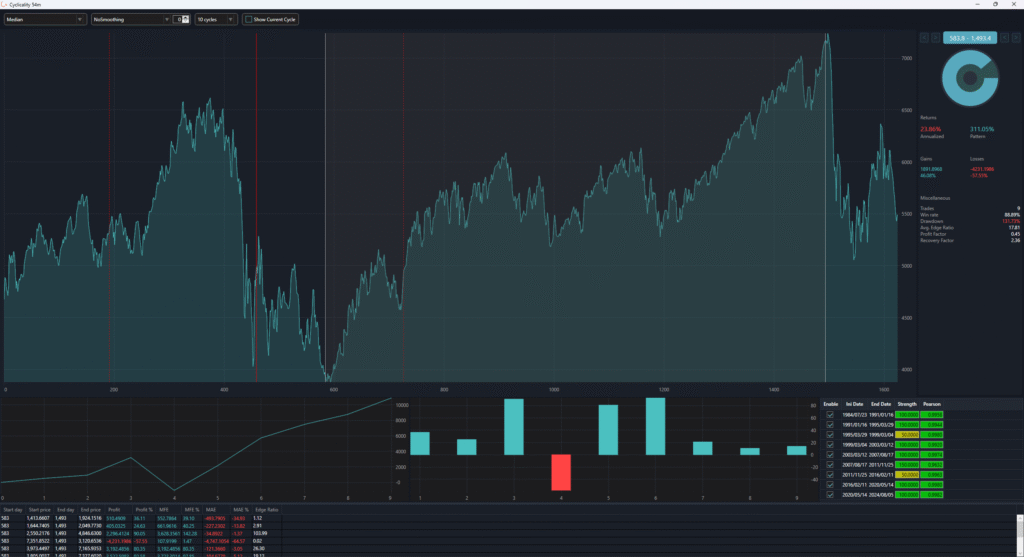

Build strategies based on economic cycles

🏛️Strategic Depth: Trading with the Great Economic Waves

TimeSeriesSCC elevates your strategy by grounding it in historical economic cycles. We move beyond simple price action by calculating the mean or median movement of monumental cycles like the Juglar, Kuznets, and Kondratieff waves.

This powerful analysis ensures you never trade in a historical vacuum.

High-Confidence Positional Trading

By accurately determining the current period mean and phase based on the existing cyclic model, the software pinpoints precisely where we are likely situated within these great waves.

This strategic awareness is invaluable. For example, knowing the current Kondratieff swing on commodities (as visually presented in the analysis above) provides a high-confidence directional bias that frames all your shorter-term trades. You gain the ability to structure and execute strategies with the authoritative backing of centuries of economic history.

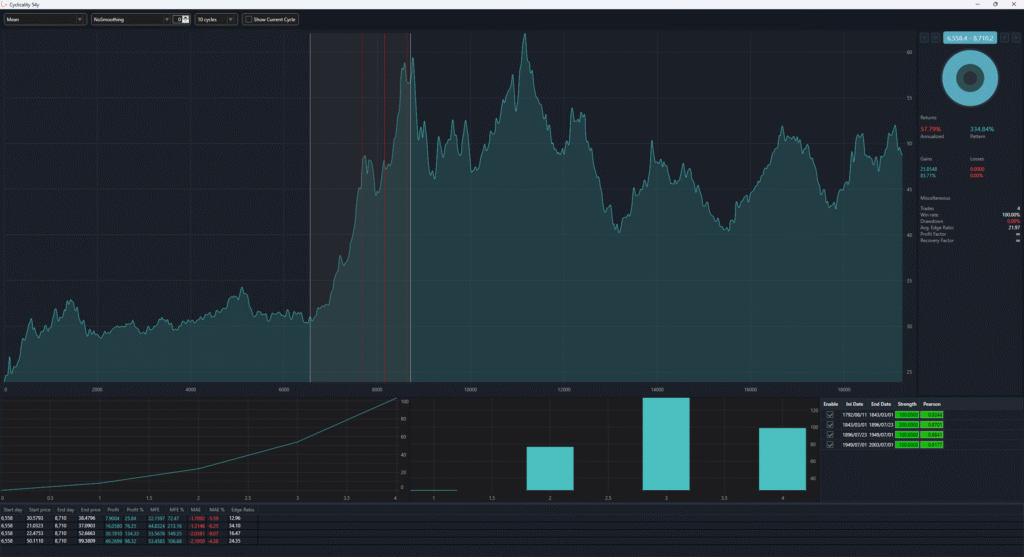

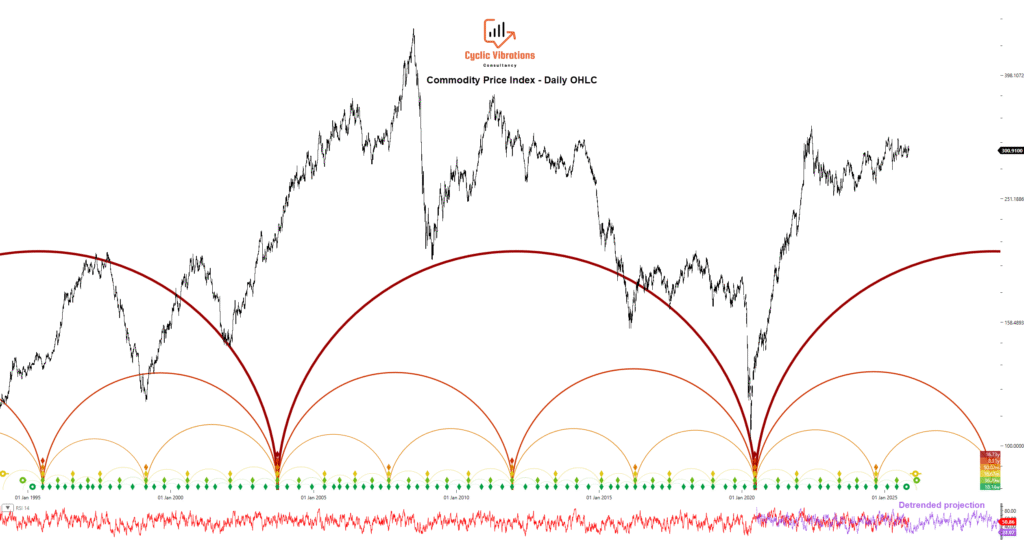

Detrended projection based on smaller waves

📈 Enhancing Cycle Analysis with Detrended Projections

When evidence for a larger economic wave’s cyclical position is scarce, you can substitute a smaller cycle’s similar circumstance, but must use a detrended projection.

Our software calculates the price projection’s Relative Strength Index (RSI), which can be overlaid with and projected into the future alongside current RSI readings.

Detrending is crucial because the summed direction of the larger economic waves often differs between the compared periods. This difference in trend leads to significant variation in peak translations between the two respective cycles.

The fluctuations of the projected RSI serve as a guide to anticipate significant price swings in the underlying asset. However, relying solely on smaller cyclical analogues makes predicting the ultimate price peak challenging due to the significant difference in trend.

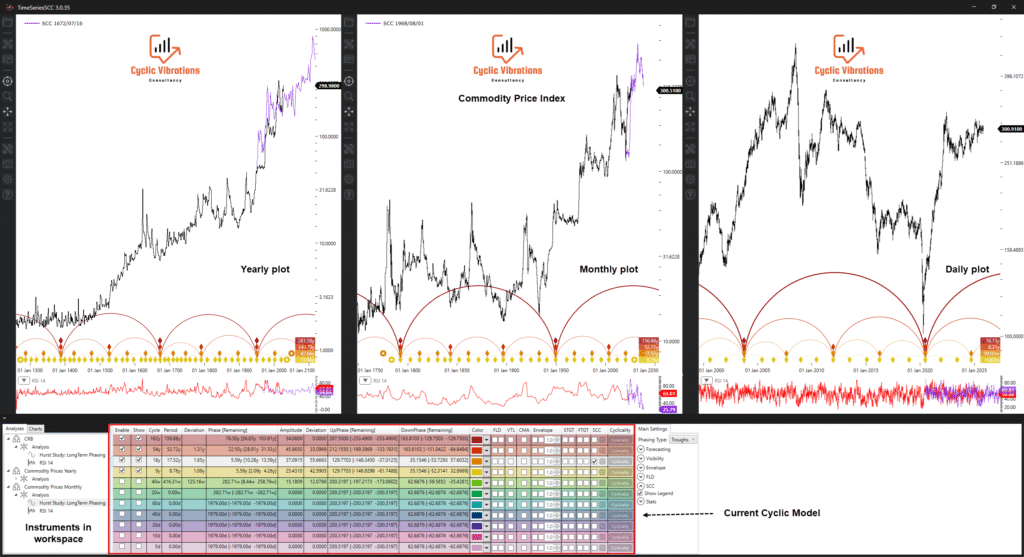

Multiple charts, multiple timeframes & multiple forms of projections

💻Dynamic Workspaces: Analyze Multiple Markets with Precision

Forget the limitations of single-instrument analysis. TimeSeriesSCC dramatically boosts your efficiency by allowing you to load several charts and instruments within a single, dynamic workspace, eliminating the need for fragmented analytical files.

Multi-Timeframe and Multi-Instrument Mastery

This capability is essential for comprehensive analysis. As demonstrated (e.g., the commodity price index), you can seamlessly view daily, monthly, and yearly data plots of the same instrument side-by-side, or analyze completely different instruments simultaneously.

Advanced Visualization and Forecasting

Once your formal phasing analysis is complete, TimeSeriesSCC offers unparalleled control over visualization and forecasting:

- Custom Projections: Instantly add projections based on the specific cycle you choose.

- Enhanced Accuracy: Achieve superior predictive precision by detrending your projections, a critical feature for increasing the reliability of shorter-cycle analogues.

- Automatic Markers: Display both Future Line of Demarcation (FLD) and Valid Trend Line (VTL) markers for your chosen cycle, which are automatically and accurately displayed on the respective charts.

TimeSeriesSCC provides the speed, context, and visual fidelity required to manage complex, multi-market strategies from one integrated platform.

Historical 18-year analogue on Gold leads to 0.95 out-of-sample correlation coefficient

🚀 The Future of Financial Analysis is Here: Don’t Just Invest, Command the Cycles.

You’ve seen the power of TimeSeriesSCC: the unprecedented 0.8+ out-of-sample correlation on the DAX, the top-notch spectral analysis that quickly builds your cyclic foundation, and the dynamic, multi-market workspaces that eliminate clutter.

This is not another automated “black box” solution. TimeSeriesSCC is the ultimate professional tool, developed from the ground up based on our CEO’s proprietary Economic Wave Theory. It places complete, granular control over formal phasing analysis, cycle selection, and statistical validation directly in your hands.

If you are a financial professional, consultant, or serious investor who refuses to rely on opaque algorithms and demands data-driven certainty, TimeSeriesSCC is your indispensable advantage.

Stop reacting to market chaos. Start predicting and capitalizing on the reliable, rhythmic forces of the market.

Ready to transform historical patterns into superior trading profits?

Take control of your analysis. Get TimeSeriesSCC today, since we have only brushed the surface in today’s article.

Recent Comments