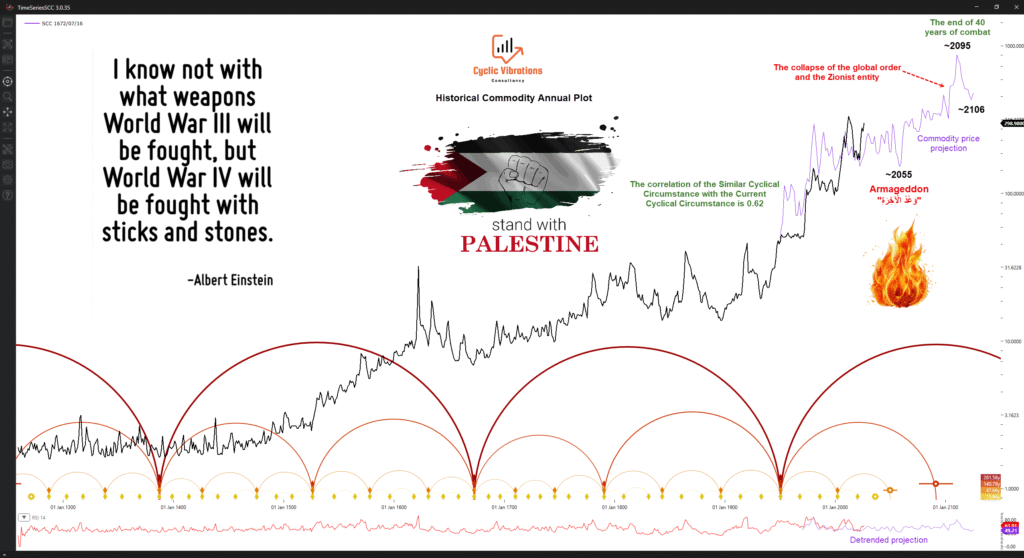

Understanding the ‘Seal of the Prophets’ in Eschatology

Image 1 The claim that a figure is the “Seal of the Prophets” fundamentally suggests a specific theological perspective on the timeline of divine revelation: namely, that the era of successive prophetic legislation is concluded. This assertion implies a belief that the Day of Resurrection and Judgment is slated to occur before the necessity arises…

Read more

Recent Comments