Our software’s forecast on the US Dollar index from 1996 to 2005.

The Formal Phasing Analysis (FPA) conducted on the US Dollar is challenging since we cannot rely on the principle of commonality to aid us in confirming the chosen cyclical troughs, given that it correlates negatively with most of the stable of instruments that we follow given that almost everything is priced in the US Dollar. The Dollar has fluctuated widely since the collapse of the Bretton Woods agreement in August 1971, providing us with data to construct forecasts for future price movements. In today’s article, we will present our software’s forecast for the period from November 1996 to May 2005, i.e., a 9-year cycle on the US Dollar index. As visible in Figure 1, we would have expected the US Dollar to experience a multi-year advance, which should reach its peak early in the second 54-month cycle of the projected 9-year cycle, followed by a sizable decline into mid-2005.

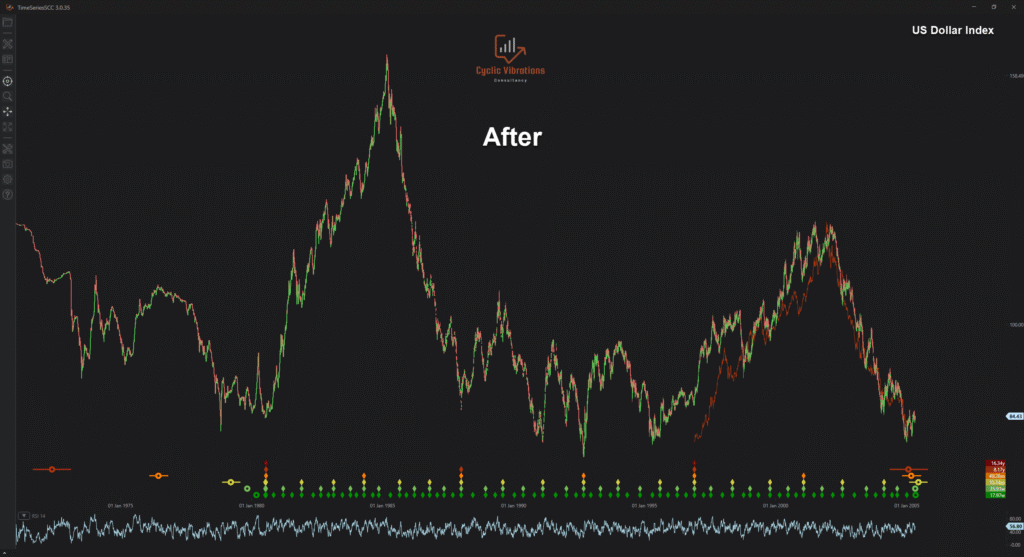

Figure 2 presents the result of our software’s forecast. The out-of-sample correlation is 0.90, which can still be improved if a scale is applied to the overall projection based on the smaller price waves to account for the principle of variation. Notice that the actual peak of the economic wave occurred very close to what was expected based on our projection (early in the second 54-month cycle). The sizable decline that was forecasted after the peak occurred with extraordinarily high correlation! The projection continued to work after 2005, and we also have projections for the future (post-June 2025). The Economic Wave Theory not only tells you the time horizon of cyclic peaks and troughs, but it also attempts to describe the minor fluctuations within the cycle of interest. It is essential to point out that major fundamental factors and acts of God present in the similar cyclical circumstance, and/or the current cyclical circumstance can reduce the correlation coefficient between the two periods. CVC will gain a lot of answers after examining how the markets will react to our future projections, especially during the remainder of 2025, since we have significant fundamental factors in the similar cyclical circumstance in many markets, so it will be interesting to examine how the current cyclical circumstance behaves from a price perspective. We will make sure to keep you posted with any new findings that we come across in the not-too-distant future!

Thank you for your time,

CVC research team.

Recent Comments